Market

RARE WHISKY 101

RARE WHISKY 101

Weekly Auction Watch by Andy Simpson – May 28, 2015

The divide between online whisky auctioneers and traditional auction houses became increasingly apparent at the recent Mulberry Bank auction in Glasgow.

As the ever growing number of lots appearing through online re-sellers continues to thrive with, in some cases 100% lot-sold rates, Mulberry Bank looked to be somewhat incongruously out on a limb.

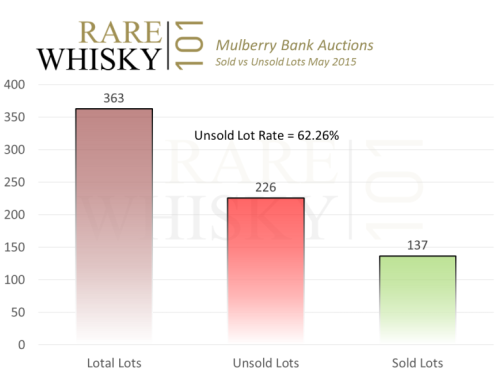

The chart below shows some basic analysis of the lot-sold ratio for this weeks auction at Mulberry Bank.

Previous unsold lot rates have been sat around 50%, however, 62% looks to be almost terminal. I haven’t done the research but I’d maybe wager proper cash (possibly even as much as a whole ten pounds!) that this is the largest unsold lot rate for any dedicated whisky auction. I’m no KPMG business analyst but this looks unsustainable in its current guise. I doff my hat off to Mulberry’s recent reduction in premiums for whisky sales. On the face of it though, this looks to have had little or no effect.

Of the 137 lots actually sold, did we see significant volumes of new records? Did whatever sold set the world on fire?

No. Sadly not.

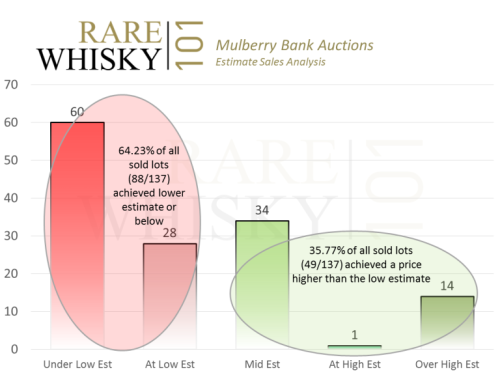

The chart below highlights some analysis of the sold lots in terms of how they performed to their estimates. These are grouped into five broad categories: Sold under lower estimate, sold at exactly lower estimate, sold between lower and higher estimate, sold at exactly higher estimate and sold over higher estimate.

Of all sold lots, almost two thirds went for their low estimate or below. Just 36% of all sold lots fetched an amount over the low estimate. Slightly separately, but interesting none the less, many of the 14 lots which sold for over their higher estimate were old Rum’s… Does this hail The Rum Investor!? Not for my palate but then that’s a purely personal thing.

As is usual here, when we see something out of the ordinary, the next question simply becomes – why?

From my perspective, and straying away from pure numbers and fact into the grey world of opinion, there were two main reasons.

Firstly, I don’t believe in estimates in the current market. If you want to sell with an overly ambitious estimate then don’t sell. I believe estimates allow auctioneers to push a vendor over the line who doesn’t really, really want to sell (saying that, for certain bottles, the right estimates can protect unique rarities for being under-sold). In todays buoyant global market, the main reasons something doesn’t achieve its true open market value are that –

Other than that, with the odd slightly outlandish peak or trough, bottles tend to sell for what would be expected. At the moment I see more unexpected peaks than troughs… the market is demand led and demand is high.

In my opinion this recent auction started to blur the line between auction and retail. It you ask a firm price for something it’s surely not a true open market? If an auctioneer has confidence in the provenance and rarity of their bottles, sellers should be equally confident in them achieving todays open market value.

Following on from that, some of the bottles simply were over-estimated and therefore destined not to sell from the word go. A small sample of (over)estimated prices vs most recent auction sales is as follows –

Glendronach 1989 22 yr old 600 bottles cask 5475 – Mulberry Bank est £230 – £300.

– Sold for £110 Jun 2014.

Ben Wyvis Final Resurrection 27 year old – Mulberry Bank est £650 – £850

– Sold for £510 Apr 2015 and £500 Dec 2014.

Ardbeg Kildalton 2014 – Mulberry Bank est £200 – £250.

– Selling for £130 – £160 in the current market.

Ardbeg Galileo – Mulberry Bank est £150 – £200

– Selling for around £120 in the current market.

Bowmore Legend Donnachie Mhor – Mulberry Bank est £80 – £120

– Currently sells for £40 – £60.

Highland Park 2000’s discontinued bottle – Mulberry Bank est £100 – £140

– Sells for around £40.

Secondly, and while I appreciate a host of people at Mulberry will have worked massively hard to land this auction, there just wasn’t much there of interest. One significant new record was achieved which I’ll mention later; however, other than providing for those with a rum-sweet tooth, there really wasn’t a great deal to float ones whisky boat. The mainstay of the Macallan’s either had poor fill levels or damaged/stained labels and most everything else was just pretty standard. The lack of rarities will, in my opinion, significantly reduce demand… a vicious circle.

Nothing of interest = No demand.

No demand = Nothing of interest coming through.

I maintain my stance that on-line is the way forward for whisky auctions (easier, faster, quicker, slicker, cheaper etc). To that degree I also find myself asking why Mulberry have a ‘real’ auction at all as anything unsold goes into an online auction anyway.

Why not just have an online auction in the first place?… But then it’s with The Saleroom.com so an additional 3% in fees are payable for winning bids. Circles are not just vicious but also frequently hard to break.

Finishing on a high note though, lot number one, a bottle of highly desirable and very limited Highland Park 27 year old sold for £1,800. The last time this sold at auction in the UK it achieved £650, so in common with these uber-collectables a significant premium was realised.

…if only Mulberry could secure more bottles like that!

Until next time.

Slainte,

Andy

We’ll respect your privacy. Also, you can unsubscribe at any time.

We’ll respect your privacy and you can unsubscribe at any time.