Market

RARE WHISKY 101

RARE WHISKY 101

Monthly Whisky Market Watch by Andy Simpson – November 1, 2016

October saw the second highest month on record from a supply perspective with 5,528 bottles of Single Malt Scotch hitting the secondary market in the UK, slightly behind August’s all-time high of 5,707. It’s incredible to think the number of bottles sold in one single month is now regularly exceeding 2010’s full year supply of 5,431.

From a pure investment perspective, October looks to have finally flushed through any Brexit forex related gains. The broadest measuring index, the Apex1000, increased by 2.20% in October, cooling from September’s 5.30% and August’s heady 6.18%.

While there’s clearly been the expected positive correlation between Sterling’s drop and certain bottles increasing, the broad market has remained underpinned by the same tried and tested principles. The ‘right’ bottles are increasing and the ‘wrong’ bottles are still languishing in the doldrums. The impact of the crash in GBP has by no means positively affected all prices; the value of some bottles has continued to fall.

Bottle(s) of the Month

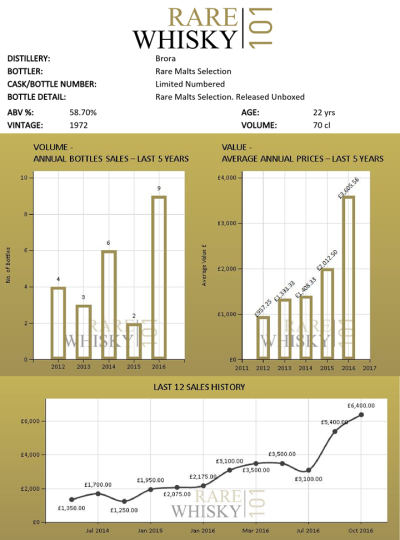

October’s highlights have to include Scotch Whisky Auctions Rare Malts Selection Brora 1972 22 year old which, in-spite of massive increases already, pushed up from its previous £5,400 record to a massive £6,400. The profile of that little gem is below.

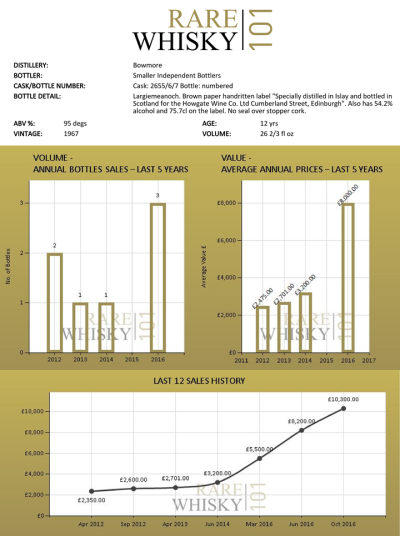

Whisky-Online Auctions took a bottle of the Largiemeanoch Bowmore 1967 from its previous best of £8,200 to £10,300. Demand for these amazing old rarities seemingly knows no bounds as the valuation history below shows.

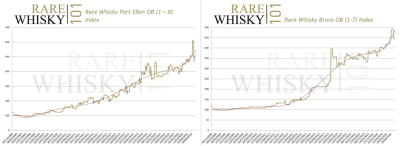

October proved to be a particularly sharp, double edged sword as Macallan continued to surge but both Brora and Port Ellen dipped dramatically. Both indices saw large peaks over earlier months which have now been erased.

The monthly % changes of the indices are ranked below together with the respective 2016 year to date results-

Oct 2016 2016 YTD

Macallan 25 Index 9.51% 53.53%

Macallan 18 Index 7.50% 100.09%

Apex 1000 Index 2.20% 28.87%

Icon 100 Index 2.03% 38.65%

Vintage 50 Index 0.40% 21.40%

Rare Malts Index -0.04% 33.88%

Karuizawa Index -2.94% -3.57%

Brora Index -9.08% 14.41%

Port Ellen Index -15.86% 18.66%

It’s the first time we’ve ever seen an index/collection double in value over the course of less than one year. The vintage Macallan 18 year olds have outstripped everything before them. Even the rapid ascent of Karuizawa prices in early / mid 2015 can’t hold a light to Macallan. As a word of caution, and as can be seen from the charts, these bottles have been through a protracted re-trace before. Whether we see any sort of cooling in rare Macallan prices is anyone’s guess; but we’re absolutely not expecting these gains to continue. They simply cannot.

While not included in the ranking above, the Negative1000 index crept slightly further into the red, cementing the risks involved in selecting the wrong bottles.

Port Ellen and Brora are also showing why Scotch should be viewed as a medium to long term investment. With peaks and troughs galore, as ever, timing is everything.

We’ll respect your privacy. Also, you can unsubscribe at any time.

We’ll respect your privacy and you can unsubscribe at any time.